Dưới đây là danh sách hay nhất và đầy đủ nhất

Finance is considered as a source of energy or a lifeblood for all business activities. Mismanaged finances and cash flow issues are the biggest problems that lead to the bankruptcy of a business, especially in the early days. While many business fail to chase payments, other enterprises spend too much.

Thus, effective financial management skill is one of the most important skills as well as good financial management is essential for the success of any business. If you, a business owner is ready to start managing business finances better, consider 7 methods to best manage your business’s finances we recommend in this article.

Table of Contents

Why do you must manage your business’s finances?

What is Business Financial Management?

Business financial management is a very important activity for any business or organization. It is a process of planning, controlling, organizing and monitoring financial resources in order to bring about common goals for your enterprise.

This important skill is considered an ideal practice to control the financial activities of a business such as: funding, procurement, bookkeeping, accounting, risk assessment, creating financial statements and managing cash flow statement

You must manage your business’s finances because it will help your business maximize profits as well as support the business to thrive and run smoothly.

In other words, financial management is the application of general principles to the assets of a business. This will help businesses maximize their profits from effective capital management. On the contrary, if financial problems are not properly resolved, the development and growth of the business will be seriously affected.

The importance of managing business finance

- Smoothening business operations: When your business’s finances are well-managed, you can ensure that the business operations are carried out smoothly.

- Improvement on value & goodwill: Good financial management not only increases net profit margin but also improves the overall value and goodwill of your business.

- Better tax planning: Proper financial management helps you build a good tax plan, thereby preventing you from losing money.

- Economic stability provision: Effective financial practices will help to provide information on economic stability during difficult times, thereby your company can easily sustain an economic downturn.

- Better future plans: Managing business finances effectively makes business owner more confident and help the company expand in the future

7 methods to best manage your business’s finances

#1 Keep your business and personal accounts separate

A lot of new small business owners commingle their personal finance with financial sources of their companies. In particular, they use their personal credit cards to cover business expenses and deposit business revenue into their personal checking accounts. It will be a disaster and you may struggle to properly manage finances and have some tax issues into the bargain.

So, at early days of your business, you should keep personal finances and business finances separately. This offers you a clear understanding of the cash that is available for business. Also, keep your finances secure without losing out on personal finance due to business difficulties and vice versa.

#2 Starting with the required financial documents

Business financial statements may provide a lot of insights into your business’s financial health. There are three basic financial statements you should know.

Balance sheet

Balance sheet is the financial statement of a company that reports a company’s assets, liabilities, equity capital, total debt, etc. at a specific point in time. It also shows your equity – the difference between assets and liabilities – the amount of money you would be left with if you sold all business assets and paid off all business debts.

The balance sheet is one of the three core financial statements used to evaluate a business.

Income statement

Income statement, also known as Profit and loss (P&L) statement, refers to a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period, usually a quarter or fiscal year.

These records provide information about a company’s ability or inability to generate profit by increasing revenue, reducing costs, or both. As a company owner, analyzing your profit and loss statement can help you know the financial health and determine which aspects of your business are profitable.

Cash flow statement

The cash flow statement summarizes the movement of cash and cash equivalents (CCE) that come in and go out of your company over a period of time.

Thus, analyzing the cash flow statement of your business can help you determine how well your company manages its cash position or how well your company generates cash to pay its debt obligations as well as fund its operating expenses.

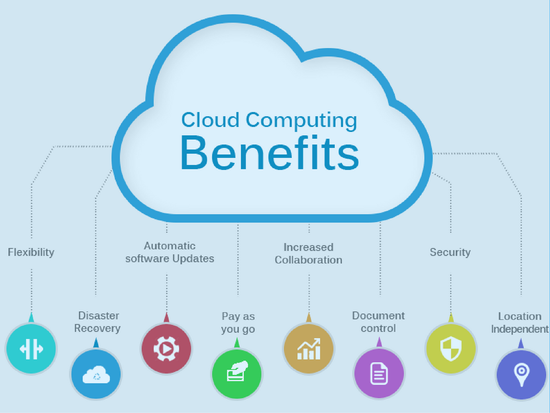

#3 Digitizing Account & Finance Management – Choosing a reliable accounting software

In our era, technology is one of the most useful tools for business owners. It takes easier to sort and store things as well as makes business activities more efficient and streamlined.

So, digitizing your documents, accounts, contracts and every other business document is considered as the best way not to feel like you are swamped with unending paperwork all the time when you should be working.

For example, you can store accounting and bookkeeping records on an accounting software, stores bank records in a mobile banking app, save all your business contacts in a note-taking app or Cloud. Further, Employee records and essential financial information can be handled by human resource software…

Surely, you could keep everything in a spreadsheet, but that might get unwieldy. At current, there are a lot of free and low-cost accounting software available for small business owners, such as QuickBooks, Wave, Zoho Books, Xero, and FreshBooks…

#4 Planning for paying business taxes

Every business has to pay income taxes on business income. So, how you pay those taxes and the tax rate you pay depends on your business structure.

Each month, you or your accountant should calculate your earnings before interest and taxes (EBIT). Then, multiply EBIT by 25% to 30% and move that amount into your business savings or money market account. This amount should be sufficient to cover the above-mentioned taxes.

This amount should be sufficient to cover state and local income taxes, as well as self-employment taxes (however, your amount may vary, so be sure to check with your tax advisor). By setting money aside on a monthly basis, you ensure that you have cash on hand to make quarterly tax payments.

By getting in the habit of setting money aside on a monthly basis, you ensure that you have cash on hand to make quarterly tax payments.

#5 Managing your debt more effectively

Debt is a fact of life, not just for personal finance but for businesses as well. Debt can be in any form of: startup funding, business credit cards, small business loans, commercial mortgage payments, or bank loans for capital equipment or property or equipment lease.

There are hardly any entirely debt-free businesses and we can only build an effective debt management plan. Thus, debt management is a way to get your debt under control through financial planning and budgeting.

Borrowing for expanding your business is just fine. However, you need to keep track of the costs associated with the borrowing, including the capital amount, the interest rate, and several hidden charges can cost you a lot of money. Further, you should build a clear financial plan to resolve the debt with the help of accountant.

#6 Managing your cash to flow well

Cash flow is one of the biggest challenge businesses, especially small one often faces. Thus, getting accurate inflow and outflow charts for your business will present you with valuable insights into your business’s valuable assets.

Accounting software may be used to generate a cash flow chart and you can need the help of an accountant to understand your business cash flow better.

Some benefits of cash flow charts are:

- Help you identify the potential risks of money problems in the business,

- Help you improve your credit rating.

- Help you plan for more significant purchases and advancements that require a more considerable amount of cash to improve the business line.

According financial experts, studying a flow of your business revenues regularly allows you to control your finances and control any expenses better.

#7 Schedule time to stay organized

Finally, setting aside time each week or month to organize your business’s finances is also an important task. This task may include: including data your financial software, filing, reviewing financial reports, scanning receipts or paying bills, invoicing, collections, etc.

According to experiences of some business owner, it takes 30-60 minutes each week or a haft a day to keep their business finances organized. Further, you should preferably put on calendar and treat it like a priority.

Business organization strategies are estimated as being essential if a business owner wants to keep his/her finances in order.

Conclusion

Managing your business’s finances is critical to keeping your business running smoothly and make profits. Also, managing your business’s finances effectively is the one which makes the business stand out from others. This skill requires each business owner to have a good financial discipline. Further, asking the professionals for advices is also a good tip you can try.

Hopefully, 7 methods to best manage your business’s finances we recommended there-above will useful for you to build an effective finance management plan for the success of your business.